In Fort Worth, traditional loan processes require extensive documentation and strict credit checks, hindering those with limited records or bad credit. Car title loans offer alternative income proof by using vehicle equity as collateral, providing flexible funding options for diverse financial backgrounds without relying solely on conventional income verification. Effective strategies include presenting employment history, verifiable income statements, and securing loans through methods like a title pawn to establish credit history and improve future loan terms.

In today’s digital age, traditional methods of providing income proof for car title loans may seem outdated. Fortunately, there are viable alternatives that offer flexibility and convenience. This article explores innovative approaches to verifying financial stability, moving beyond conventional income proof methods. We’ll delve into the world of alternative verification options, empowering borrowers with diverse strategies to demonstrate their economic reliability. Discover practical ways to navigate the loan process seamlessly while leveraging modern solutions for car title loan income proof alternatives.

- Traditional Income Proof Methods Explained

- Alternative Verification Options for Loans

- Effective Strategies to Demonstrate Financial Stability

Traditional Income Proof Methods Explained

In the traditional lending landscape, income proof is a critical component for securing loans, especially when considering options like Fort Worth Loans or secured loans. The purpose of this requirement is to assess an individual’s financial stability and repayment capacity. Typically, lenders demand traditional documents such as pay stubs, tax returns, or bank statements to verify the borrower’s monthly earnings. These methods have been the cornerstone of loan approval processes for years, ensuring a level of transparency and predictability in repayment.

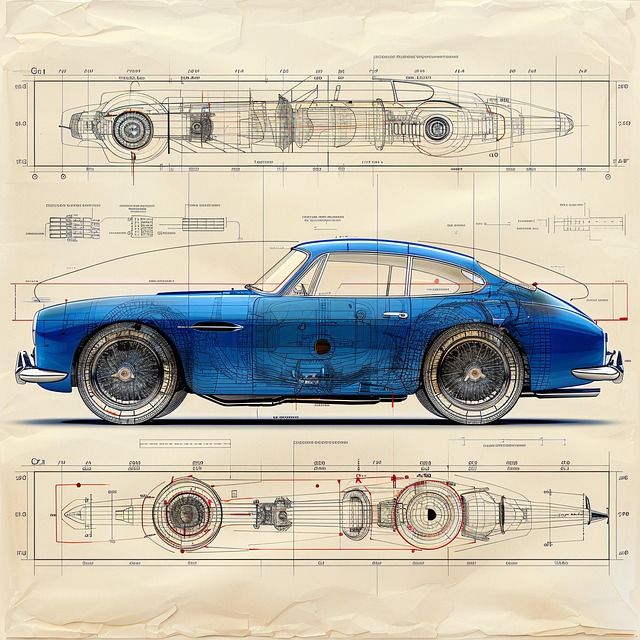

However, with evolving financial times and diverse borrower needs, there is a growing demand for alternative income proof options, particularly for those who may not have access to conventional documentation. Car title loans, for instance, offer a unique solution where individuals can use their vehicle’s equity as collateral, providing a means of securing funds without the need for traditional income proof. This approach, often referred to as car title loan income proof alternatives, allows borrowers to keep their vehicle while accessing much-needed capital.

Alternative Verification Options for Loans

When it comes to securing a loan, traditional methods often require extensive documentation and strict credit checks. However, for individuals with limited financial records or less-than-perfect credit, this can be a significant barrier. Thankfully, there are alternative verification options available, especially when considering car title loans. Instead of relying solely on income proof, lenders can assess borrowers’ asset value, including the equity in their vehicles. This approach offers flexibility and accessibility, providing relief for those with limited documentation or bad credit history.

One such alternative is using vehicle registration documents and insurance papers as verification. These provide evidence of ownership and can be a reliable indicator of financial stability. Additionally, lenders may consider other factors like employment history, utility bills, or bank statements (when available) to gauge the borrower’s ability to repay the loan. Such alternatives to car title loan income proof ensure that individuals with diverse financial backgrounds have access to much-needed funds without being hindered by strict lending requirements, including those related to bad credit loans and loan terms.

Effective Strategies to Demonstrate Financial Stability

Demonstrating financial stability is a key aspect when seeking alternative loan options, especially when traditional lending routes may be inaccessible. Car title loan income proof alternatives offer individuals a way to access quick funding by utilizing their vehicle as collateral. One effective strategy is to present a consistent employment history and verifiable income statements. This can include pay stubs, tax returns, or bank statements showcasing stable earnings.

Additionally, establishing a solid credit history through secured loans can enhance one’s financial standing. A title pawn, for instance, allows individuals to borrow against the equity in their vehicle while providing clear proof of repayment capacity. These methods not only offer rapid funding but also demonstrate a borrower’s ability to manage financial obligations responsibly, thereby increasing the likelihood of securing future loans with more favorable terms.

When exploring car title loan options, traditional income proof methods are not the only way to demonstrate financial stability. In today’s digital age, alternative verification options offer flexible and convenient solutions for borrowers. By employing innovative strategies like bank statements, pay stubs from employers, or even tax returns, individuals can access much-needed funds without facing stringent requirements. These car title loan income proof alternatives empower folks to navigate their financial labyrinth with greater ease, ensuring they have access to resources when it matters most.